Hard Money Atlanta Fundamentals Explained

Wiki Article

Examine This Report on Hard Money Atlanta

Table of ContentsThe 6-Minute Rule for Hard Money AtlantaThe Basic Principles Of Hard Money Atlanta Everything about Hard Money AtlantaGetting The Hard Money Atlanta To WorkThe Definitive Guide to Hard Money Atlanta

In most areas, rate of interest on difficult money lendings run from 10% to 15%. Additionally, a consumer may need to pay 3 to 5 factors, based on the complete loan amount, plus any type of appropriate evaluation, examination, and also management costs. Numerous difficult cash loan providers call for interest-only payments during the short duration of the car loan. hard money atlanta.Difficult money lending institutions make their money from the passion, points, and also charges credited the borrower. These lending institutions look to make a fast turn-around on their financial investment, therefore the higher rate of interest prices and also much shorter terms of tough money car loans. A hard cash lending is a great concept if a customer requires money promptly to purchase a residential or commercial property that can be rehabbed and flipped, or rehabbed, rented and also re-financed in a reasonably short duration of time.

The Greatest Guide To Hard Money Atlanta

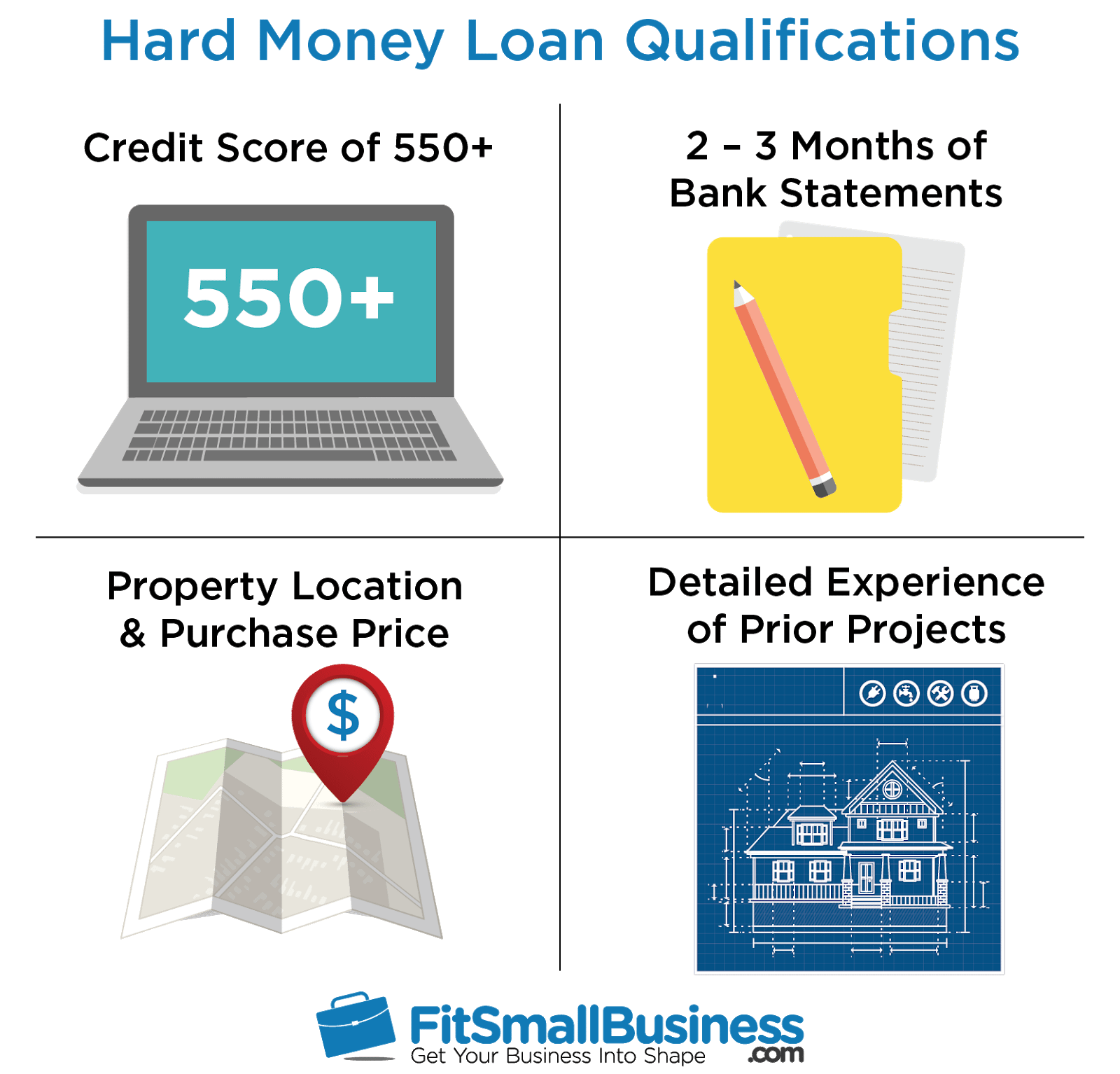

For exclusive capitalists, the ideal part of obtaining a difficult cash car loan is that it is less complex than getting a standard home loan from a bank. The approval procedure is typically much less extreme. Banks can request a nearly countless collection of records and take numerous weeks to months to obtain a loan accepted.The primary purpose is to see to it the debtor has an exit technique and isn't in monetary wreck. Yet several tough cash lending institutions will certainly work with individuals who do not have wonderful credit rating, as this isn't their greatest concern. The most vital thing difficult cash lenders will consider is the financial investment home itself.

The Hard Money Atlanta PDFs

But there is one more benefit built right into this process: You get a second set of eyes on your deal and one that is materially spent in the task's outcome at that! If a deal is poor, you can be rather confident that a difficult money loan provider won't touch it. Nevertheless, you ought to see this page never ever make use of that as an excuse to forgo your own due persistance.The very best area to seek difficult money lenders is in the Larger, Pockets Tough Cash Lender Directory Site or your local Property Investors Organization. Remember, if they've done right by another financier, they are likely to do right by you.

Check out on as we review tough money finances and why they are such an eye-catching alternative for fix-and-flip real estate financiers. One major benefit of difficult cash for a fix-and-flip financier is leveraging a trusted lender's dependable funding as well as speed.

An Unbiased View of Hard Money Atlanta

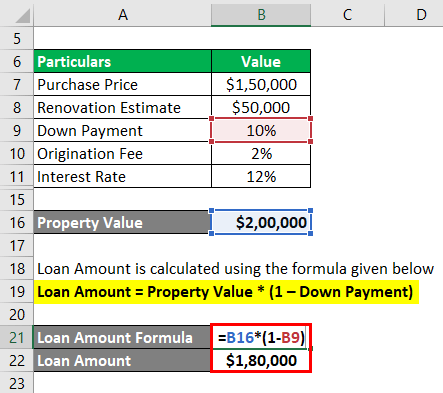

You can handle tasks incrementally with these calculated loans that permit you to rehab with just 10 - 30% down (relying on the loan provider). Tough cash financings are commonly temporary car loans used by investor to fund repair and also flip residential or commercial properties or various other real estate investment offers. The property itself is used as security for the funding, as well as the quality of the genuine estate offer is, for that reason, more crucial than the consumer's credit reliability when receiving the finance.Nonetheless, this also means that the threat is greater on these lendings, so the rates of interest are generally higher as well. Repair and my review here also flip investors choose tough money due to the fact that the marketplace does not wait. When the chance emerges, as well as you're prepared to obtain your project right into the rehabilitation phase, a tough money financing obtains you the cash money straightaway, pending a reasonable evaluation of the company bargain.

Inevitably, your terms will certainly depend on the difficult cash lender you pick to work with and your special scenarios. The majority of difficult cash lenders operate in your area or just in certain regions.

Hard Money Atlanta for Dummies

Intent and property documentation includes visit the website your in-depth extent of work (SOW) and also insurance policy (hard money atlanta). To evaluate the residential property, your loan provider will consider the worth of similar properties in the location and their projections for development. Adhering to an estimate of the residential or commercial property's ARV, they will money an agreed-upon portion of that value.This is where your Range of Work (SOW) enters into play. Your SOW is a document that information the job you plan to perform at the residential or commercial property and also is normally required by the majority of difficult money lending institutions. It consists of improvement expenses, responsibilities of the parties included, and also, often, a timeline of the deliverables.

Let's assume that your property does not have an ended up cellar, however you are preparing to complete it per your scope of job. Your ARV will certainly be based upon the sold rates of comparable residences with finished cellars. Those costs are most likely to be higher than those of homes without finished cellars, hence boosting your ARV as well as potentially qualifying you for a greater car loan quantity. hard money atlanta.

Report this wiki page